- CryptoTalk

- Posts

- Bitcoin’s Path to $100K Unstoppable

Bitcoin’s Path to $100K Unstoppable

Nvidia Joins Dow, Intel Out and Net-Zero Goal Requires $75 Trillion

CRYPTO

Bitcoin’s Path to $100K Unstoppable

Bitcoin is still on track to reach $100,000, regardless of who wins the 2024 U.S. presidential election. The increased interest in favorable crypto regulations and Bitcoin’s role as a financial hedge point to its resilience and growth potential in any political outcome. Both candidates, former President Donald Trump and Vice President Kamala Harris, bring unique approaches to cryptocurrency regulation, impacting sentiment but not the overall trajectory toward higher valuations.

Trump’s pro-crypto stance and potential to reduce regulatory obstacles could spur market excitement. Meanwhile, Harris's focus on consumer protection and transparent regulations might encourage balanced growth in the industry, catering to long-term investors.

The driving force behind Bitcoin's rise is not just election results but also economic instability, with high national debt and inflation concerns encouraging investors to view Bitcoin as a hedge. Additionally, increased regulatory clarity and the approval of Bitcoin ETFs have brought greater confidence and institutional interest into the market.

Bitcoin’s decentralized structure and limited supply position it as a unique asset that thrives under uncertain market conditions. With regulatory improvements on the horizon, Bitcoin's momentum toward $100,000 is stronger than ever.

Source

New Decentraland desktop client for Mac and Windows

Enhanced avatars and social interactions

Improved performance and upgraded environments

New features: badges, daily quests, and mini-games

DOW

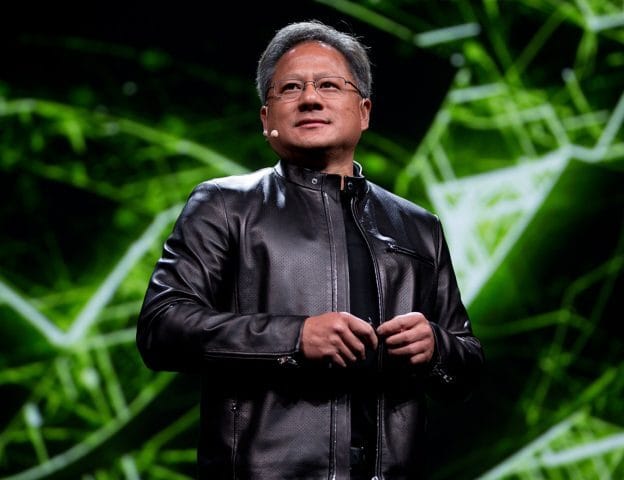

Nvidia Joins Dow, Intel Out

Nvidia is set to replace Intel on the Dow Jones Industrial Average, marking a significant shift in the chip sector and highlighting AI's growing role in the U.S. economy. The change, effective November 8, symbolizes a historic pivot as Nvidia, a leader in AI chips, steps in for Intel, which has been on the index since 1999.

This move by S&P Dow Jones Indices also includes replacing chemical manufacturer Dow with Sherwin-Williams, a major paint company. Nvidia’s stock has surged by over 180% this year, driven by high demand for its AI processors, which are essential for advancing generative AI technologies. Meanwhile, Intel, a Silicon Valley icon, has faced difficulties adapting to the AI boom, resulting in a 50% drop in its shares.

The Dow, unlike the S&P 500, is price-weighted and thus favors higher-priced stocks, with tech giants like Apple and Microsoft among its members.

Source

GOLDMAN SACHS

Net-Zero Goal Requires $75 Trillion

Goldman Sachs projects that achieving net-zero emissions by 2070 will demand a massive $75 trillion investment—over twice the U.S. GDP. This investment is vital to curbing climate change, offsetting the greenhouse gases released through human activities. Under the Paris Agreement, nearly 200 nations committed to limiting global warming to below 1.5 degrees Celsius. However, with rapid warming trends, the World Meteorological Organization warns that this limit could be breached within five years. Goldman’s updated forecast now estimates that $75 trillion will be needed to keep temperatures from rising above 2 degrees.

This capital would support advancements in renewable energy, clean hydrogen, carbon capture, and improved battery storage. Specifically, $30 trillion should go toward renewables, with $5 trillion invested in energy storage, and $9.3 trillion in eco-friendly industrial practices. Fossil fuels will still play a transitional role, with oil demand peaking around 2029 and natural gas used through 2050.

Source

U.S. Treasurys

10-Year Yield Tops 4.3% Again

The 10-year Treasury yield rose above 4.3% as traders shrugged off a weaker-than-expected jobs report. Yields climbed almost 10 basis points to 4.382%, continuing a recent recovery from October. The 2-year Treasury yield also rose, increasing by 5 basis points to 4.216%. This yield movement follows a Bureau of Labor Statistics report that showed just 12,000 new jobs in October—well below Wall Street’s expectations of 100,000. Hurricanes and strikes, including at Boeing, affected the job data, tempering market reaction.

Despite the softer jobs report, traders still anticipate a possible Federal Reserve rate cut in their upcoming November 7 meeting. Analysts, including Lindsay Rosner from Goldman Sachs Asset Management, suggest the Fed may interpret the weak data as influenced by temporary factors, potentially reinforcing an easing stance. The Fed's next decision is also informed by recent inflation data; September’s personal consumption expenditures (PCE) price index met expectations, rising 2.1% annually and 0.2% monthly.

Source

Meme of the day

Word of the day

Extricate

To extricate someone or something is to free or remove that person or thing from an entanglement or difficulty, such as a trap or a difficult conversation.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.