- CryptoTalk

- Posts

- Bitcoin ETF Liquidity Set to Surge

Bitcoin ETF Liquidity Set to Surge

Bitcoin ETF Inflows Surge, Whales Accumulateand Inflation Progress, But Costs Still High

Good morning, friends! It’s the last day of the week, and it's going to be an amazing Sunday. I’m about to create today’s newsletter and then head out for a run to get some fresh air. I hope each of you has a great day as well! In today’s newsletter, we will cover:

-Bitcoin ETF Liquidity Set to Surge

-Bitcoin ETF Inflows Surge, Whales Accumulate

-Inflation Progress, But Costs Still High

-Boeing Offers 35% Raise to End Strike

CRYPTO

Bitcoin ETF Liquidity Set to Surge

Bitcoin's liquidity is set to surge with the recent SEC approval of options trading for spot Bitcoin exchange-traded funds (ETFs). This is a major development that could drive significant inflows into these ETFs. On October 18, the U.S. Securities and Exchange Commission (SEC) gave the green light to the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE) to list options for spot Bitcoin ETFs. This approval applies to 11 Bitcoin ETF providers, opening the door for more sophisticated trading strategies and higher liquidity.

QCP Capital, a trading firm, noted that institutional demand for Bitcoin remains strong, as highlighted by consistent inflows into these ETFs. In their October 19 research note, they emphasized that this SEC approval could enhance ETF liquidity, making them more attractive to large investors. The availability of options trading will allow for better risk management and speculation, which in turn should fuel even more inflows.

With sustained ETF inflows, Bitcoin could potentially hit new all-time highs. ETFs have been a major source of investment in Bitcoin, contributing to around 75% of new investments when the cryptocurrency crossed the $50,000 mark earlier this year. This boost in liquidity might propel Bitcoin’s next major rally.

Source

CRYPTO

Bitcoin ETF Inflows Surge, Whales Accumulate

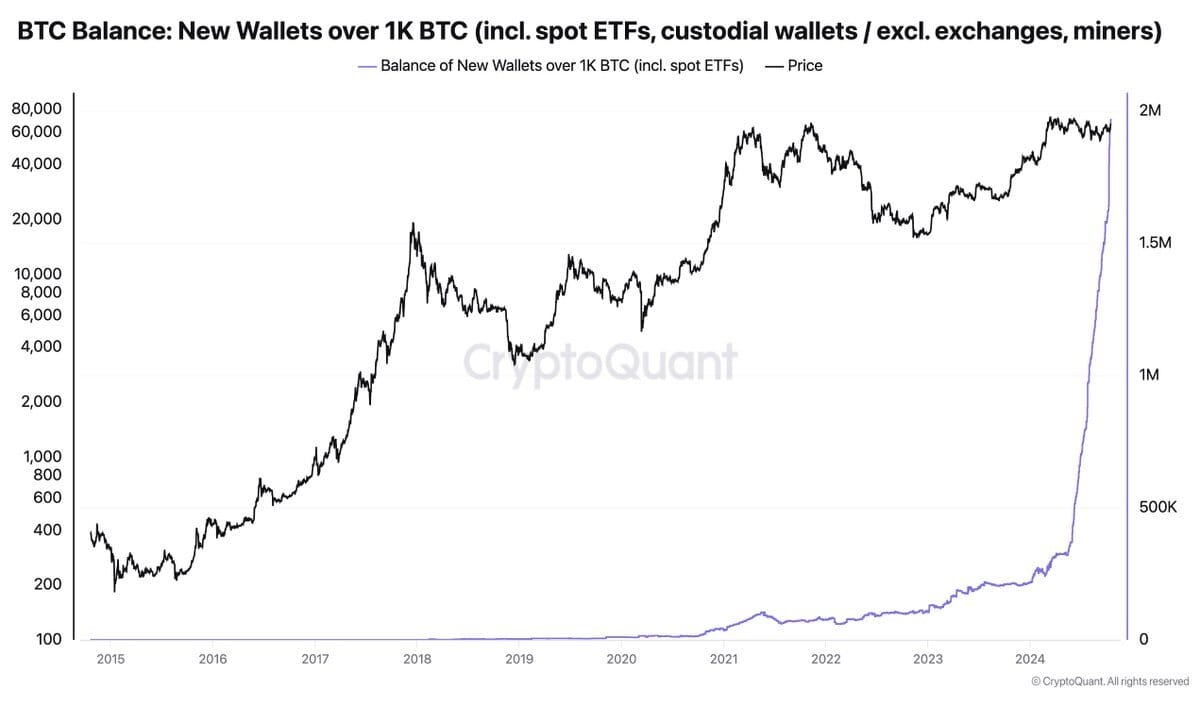

This week, Bitcoin ETFs saw an explosive surge in inflows, hitting over $2.1 billion. That's a 580% jump, marking the highest weekly inflows since March 2024. Notably, it’s the first time in history that Bitcoin ETFs have crossed the $2 billion mark in a single week. Over the last six days, inflows remained positive, bringing the total net inflows to a record-breaking $20.94 billion, a feat that took gold ETFs years to achieve but Bitcoin managed in under a year.

On October 14th, inflows reached a peak of $555 million before slowing down slightly to $273 million by October 18th. This rapid accumulation signals strong interest from both retail and institutional investors.

What’s particularly interesting is the whale activity. Analysts are drawing comparisons between current whale accumulation and the buildup leading to the 2020 rally. CryptoQuant’s Woominkyu noted that the whale ratio on spot exchanges looks similar to July 2020, just before Bitcoin's price skyrocketed after the COVID crash. This could be a sign that large investors are preparing for another significant rally in the near future. Overall, this week's ETF inflows and whale activity paint a promising picture for Bitcoin's market trajectory.

Source

INFLATION

Inflation Progress, But Costs Still High

Although inflation in the U.S. appears to be easing, it remains a significant problem. Prices for essential goods and services, like food and gasoline, have risen sharply since 2021—eggs are up 87%, auto insurance 47%, and gas, though falling, is still 16% higher.

While debt delinquency rates, currently at 2.74%, are the highest in nearly 12 years, they haven’t yet caused widespread issues but could become problematic soon. Despite nearing the Federal Reserve's 2% inflation target, as projected by Goldman Sachs, inflation is complex and varies across different economic sectors.

Many Americans and some Fed officials remain uneasy about the still-high costs. Even with signs of progress, Fed officials, including San Francisco Fed President Mary Daly, warn that vigilance is essential, as inflation control is not yet a guaranteed success. The Fed’s next policy decision in November will be crucial.

Source

BOEING

Boeing Offers 35% Raise to End Strike

Boeing is trying to resolve a major strike involving 33,000 workers by proposing a new contract with a 35% wage hike over four years. This offer also includes a 4% annual bonus and a $7,000 incentive if the workers approve it.

The White House stepped in to mediate, with Acting Secretary of Labor Julie Su playing a key role in negotiations. President Biden supports the collective bargaining process, leaving the final decision to the workers. Boeing's new CEO, Kelly Ortberg, who joined in August, faces pressure to resolve the strike ahead of the company’s third-quarter earnings report.

The workers previously rejected an earlier offer, but Boeing has since improved its bid, hoping this deal will finally bring an end to the strike. A ratification vote is set for October 23, and the outcome will be critical for both the company and its workforce.

Source

Meme of the day

Word of the day

Defenestration

Defenestration is most often used to refer to a usually swift dismissal or expulsion, as from a political party or office. It is also used to refer to a throwing of a person or thing out of a window.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.